Despite the difficult moment we are all facing and despite the lockdown, which does not allow travelling, we are proud to keep the Balkan Asset Management Interagency Network (BAMIN) active by organising online activities.

SAFE, being part of the BAMIN Secretariat, successfully completed the second BAMIN Steering Group Meeting on the 3rd of June 2020, being the first-ever delivered Online.

During the SGM, the discussion covered several topics, among which the postponement of the BAMIN Annual General Meeting due to the COVID19 travel restrictions and the planning of future activities for the year. Furthermore, the BAMIN website has been finalised and will be granting access to a private area for BAMIN Members where to upload files and access a repository with training material and informative documents.

The first Online SGM success, ensure that any future activity, if unable to be held live, will still be successfully delivered.

What is more, on the 4th of June the Online Training on Management of Crypto Assets for BAMIN was delivered. It is the first training delivered within BAMIN activities.

The speakers were experts from private and public entities from the UK – Mr Aidan Larkin from Asset Reality, Belgium – Mr Jean-Michel Verelst Deputy King’s Prosecutor of Brussels, and Ireland, Mr Nigel Petrie.

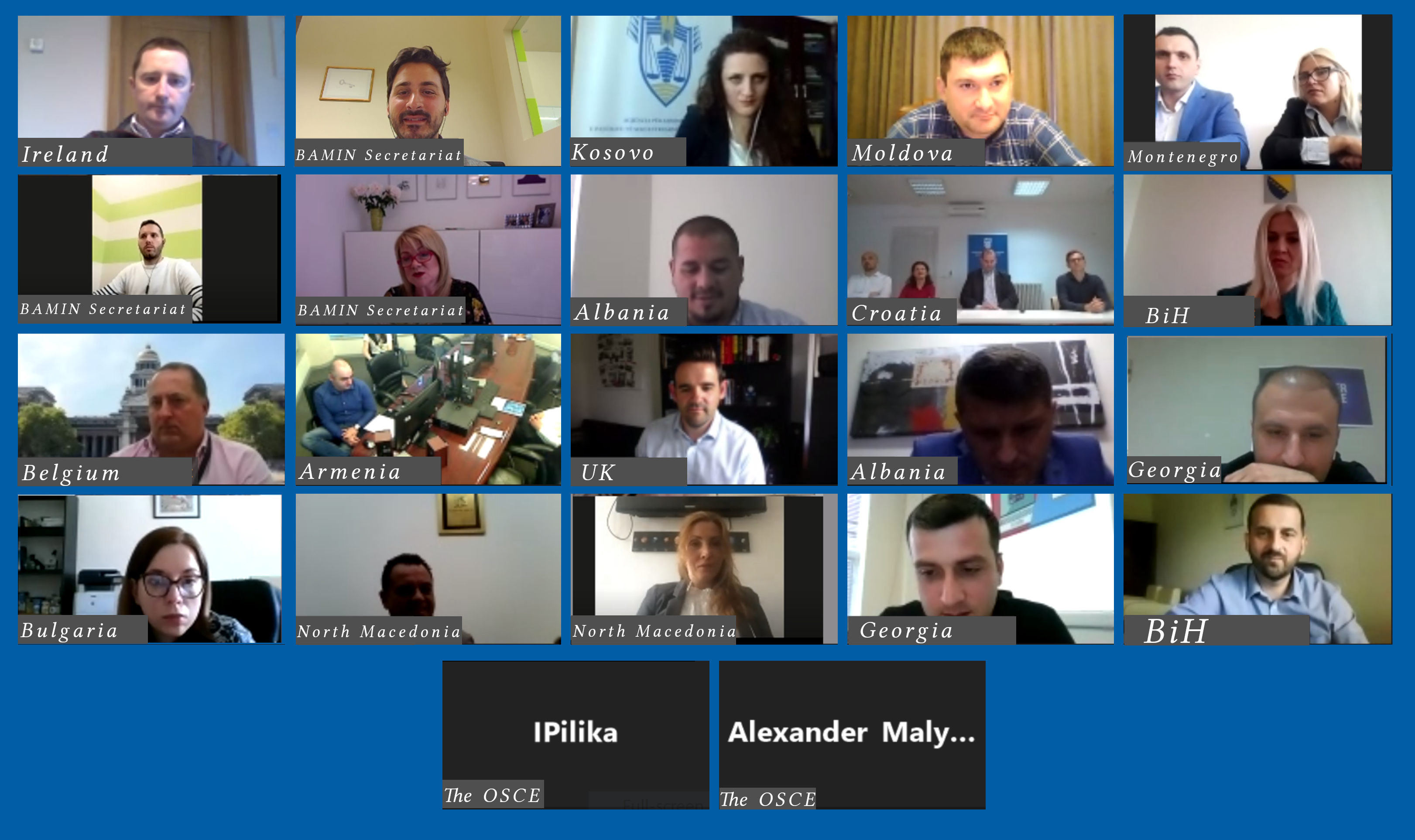

BAMIN Members as well as Practitioners from other countries who showed interest in the Network participated in the training. Overall, the training saw the attendance of over 14 different countries (Albania, Armenia, Belgium, Bosnia Herzegovina, Republic of Srpska, Bulgaria, Croatia, Federation of Bosnia and Herzegovina, Georgia, Ireland, Kosovo, Moldova, Montenegro, North Macedonia, UK) representing Asset Management Offices and other relevant institutions.

The training started providing some background information on the Crypto Assets, ensuring that all participants would have an understanding of the topic. The second session provided a Belgian Case Study on the Management of Crypto Currencies, explaining the best practice when selling seized assets and the security behind these transactions.

The first afternoon session provided the focused on the Academic Research being conducted by Mr Petrie on Harmonising the Management of Crypto Assets and the importance of Standardisation. Lastly, the last session of the training moved toward the Advanced Crypto Assets for BAMIN Practitioner, in particular the challenges existing in dealing with Crypto Assets as well as providing the international point of view.

The training was a success, with the attendees participating actively and raising questions while enhancing their knowledge and awareness of this constantly changing and challenging topic.

Both the Steering Group and the Training were delivered thanks to the funding of the OSCE.